LIC Plan 814 Maturity Calculator: Your Complete Guide to the New Endowment Plan

LIC Plan 814 Maturity Calculator

Estimated Annual Premium: ₹${annualPremium.toFixed(2)}

Estimated Maturity Value: ₹${maturityValue.toFixed(2)}

Total Estimated Bonus: ₹${totalBonus.toFixed(2)}

Note: These calculations are estimates and may vary from actual values.

`; }function calculatePremium(age, term, sumAssured) { // This is a simplified premium calculation // In reality, LIC uses complex actuarial tables to determine premiums let basePremium = (sumAssured / term) / 10; let ageFactor = 1 + (age / 100); return basePremium * ageFactor; }Hello Freinds! Are you looking for a LIC Plan 814 maturity calculator? to secure your financial future? Well, you’re in the right place. Today, we’re diving deep into LIC Plan 814, also known as the New Endowment Plan.

We’ll explore its features, benefits, and, most importantly, how to use the maturity calculator to make smart decisions for your future.

What is LIC Plan 814?

LIC Plan 814 is a life insurance policy offered by the Life Insurance Corporation of India. It’s not just any policy, though. This plan is a powerhouse that combines protection and savings in one neat package. Here’s what makes it special:

- It’s a participating plan, which means you get to share in LIC’s profits through bonuses.

- It’s non-linked, so your returns aren’t tied to the ups and downs of the market.

- It offers both life coverage and a maturity benefit.

Key Features of LIC Plan 814:

| Feature | Details |

| Plan Type | Non-linked, with-profits endowment policy |

| Eligibility Criteria | Entry age: 8 to 55 years |

| Policy Term | 12 to 35 years |

| Premium Payment Modes | Yearly, Half-Yearly, Quarterly, Monthly |

| Sum Assured | Minimum: ₹1,00,000; No Maximum Limit |

| Bonuses | Reversionary and Final Addition Bonus |

| Loan Against Policy | Available after 3 years |

| Tax Benefits | Under Sections 80C and 10(10D) of the IT Act |

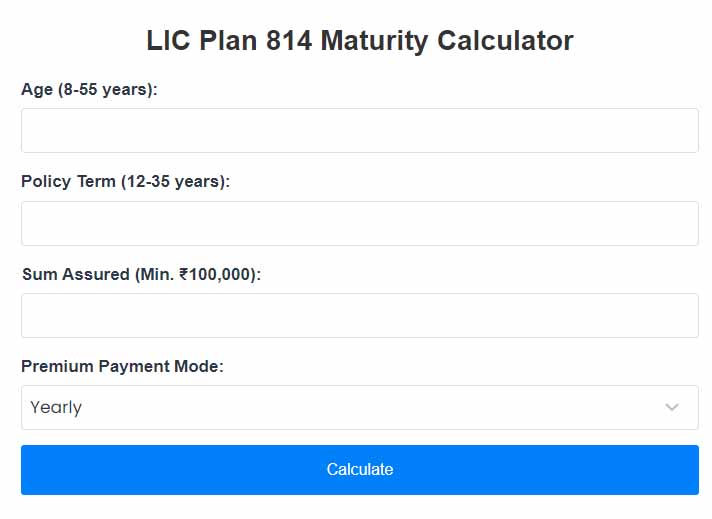

How to Use the LIC Plan 814 Maturity Calculator

Now, let’s get to the exciting part—the maturity calculator! This tool is your crystal ball for financial planning. Here’s how to use it:

- Enter your current age.

- Choose your desired policy term (remember, 12 to 35 years).

- Select the sum assured (minimum Rs. 100,000).

- Pick your premium payment mode (yearly, half-yearly, quarterly, or monthly).

- Hit that ‘Calculate’ button!

The calculator will show you:

- Your premium amount

- The maturity amount (including bonuses)

- The death benefit amount

Benefits of LIC Plan 814

This plan comes with the following benefits: –

- Death Benefit: If the worst happens, your family is protected. They’ll receive the sum assured on death plus bonuses.

- Maturity Benefit: Live to the end of the policy term? You get the basic sum assured plus all the bonuses you’ve accumulated. It’s like a reward for your patience!

- Bonus Bonanza: You get simple reversionary bonuses every year. There’s also a chance for a final additional bonus. More money in your pocket!

- Loan Facility: Need cash? You can take a loan against your policy once it acquires a surrender value.

- Accidental Death Benefit: This is an optional rider. If you choose it, your family gets extra protection if you die in an accident.

- Tax Benefits: Your premiums can get you tax deductions under Section 80C. The maturity amount is tax-free under Section 10(10D).

Eligibility Criteria

Can you get this policy? Let’s see:

- You must be at least 8 years old.

- You can’t be older than 55 years old when you start

- The policy term is between 12 and 35 years.

- You must be in good health (the insurer might ask for a medical check-up).

Premium payment options

Flexibility is key when it comes to paying premiums. LIC Plan 814 offers several options:

- Yearly: Pay once a year.

- Half-yearly: Pay twice a year.

- Quarterly: Pay four times a year.

- Monthly: Pay every month (only through ECS).

Choose what works best for your budget and cash flow.

Maturity and Death Benefits Explained

Let’s break these down:

Maturity Benefit:

- You get the basic sum assured.

- Plus, all the simple reversionary bonuses

- And maybe a final additional bonus

It’s like a big financial hug at the end of your policy term!

Death Benefit:

- Your family gets the “Sum Assured on Death.”

- This is higher than:

- Basic Sum Assured

- 10 times the annualized premium

- Plus, all the vested simple reversionary bonuses

- And any final additional bonus

It’s designed to provide significant financial support to your loved ones.

Tax Benefits:

Who doesn’t love saving on taxes? With LIC Plan 814, you can:

- Get tax deductions on premiums under Section 80C.

- Receive the maturity amount tax-free under Section 10(10D).

Remember, tax laws can change. Always check the latest rules!

Revival of Lapsed Policy

Life happens, and you might miss a premium. Don’t worry! You can revive a lapsed policy within 2 years. You’ll need to:

- Pay all due premiums.

- Pay interest (as decided by LIC).

- Provide proof of continued good health.

It’s like a second chance for your policy!

Surrender Value

Need to exit early? After paying premiums for at least three years, you can surrender the policy. You’ll get:

- A percentage of premiums paid

- Plus, the surrender value of bonuses

But remember, it’s usually best to stick it out till maturity!

Why choose LIC Plan 814?

- It’s from LIC, a trusted name in insurance.

- It combines protection and savings.

- Offers bonuses to boost your returns.

- Provides tax benefits

- It gives you financial flexibility with a loan option.

Other Related Calculators

- LIC Plan 133 Maturity Calculator

- LIC Plan 178 Maturity Calculator

- LIC Child Plan Calculator [Plan No. 934 & 932]

- LIC Jeevan Saral Plan 165 Maturity Calculator

- LIC Plan 815 Maturity Calculator

- LIC Plan 836 Maturity Calculator

Conclusion

LIC Plan 814 is more than just an insurance policy. It’s a tool for building your financial future. Use the LIC Plan 814 maturity calculator to see how it fits into your plans.

Remember, the best financial decisions are informed decisions. So, crunch those numbers, consider your goals, and choose wisely!

FAQs

What is the minimum sum assured for LIC Plan 814?

The minimum sum assured is Rs. 100,000.

Can I get a loan on this policy?

Yes, you can get a loan after the policy acquires a surrender value.

What happens if I stop paying premiums?

If you’ve paid for at least 3 years, your policy becomes paid-up with reduced benefits.

Is there a medical test for this policy?

It depends on your age, so rest assured. LIC will inform you if a medical test is needed.

Can I surrender this policy?

Yes, you can surrender after paying premiums for at least 3 years.

How are bonuses calculated?

Bonuses are declared annually based on LIC’s performance. They’re a percentage of your sum, assured.

Can I change my premium payment mode?

Yes, you can change your premium payment mode on any policy anniversary.