LIC Plan Calculator

LIC Plan Calculator-2025

LIC Plan Calculator is an online tool. You can calculate the various LIC plan’s estimate which is offered by the Life Insurance Corporation of India. LIC Plan Calculator run in different factors and parameters. E.g- Estimate Premium, Death Benefit, Survival Benefit, Maturity Benefit Accidental Death and Disability Benefit etc.

The online LIC Plan Calculator tool is very useful for LIC workers as well as common people. You can estimate each LIC plan within a few clicks. So why late? It’s the right time to find the best LIC plan for Your Financial Goals!

- LIC 917 Plan Calculator

- LIC Plan 178 Maturity Calculator

- LIC Plan 133 Maturity Calculator

- LIC Plan 815 Maturity Calculator

- LIC Plan 836 Maturity Calculator

- LIC Plan 814 Maturity Calculator

- LIC Plan 833 Maturity Calculator

- LIC Child Plan 832 Premium Calculator

- LIC Child Plan Calculator [Plan No. 934 & 932]

- LIC Jeevan Saral Plan 165 Maturity Calculator

- LIC Dhan Vriddhi Plan Calculator

- LIC New Jeevan Shanti Plan Calculator

- LIC 914 Plan Calculator

- LIC Jeevan Rakshak Plan 827 Maturity Calculator

- LIC Jeevan Utsav Plan Calculator [771 &871]

What is a LIC Plan Calculator?

If you want to know your LIC investment future calculation. The LIC Plan Calculator will help you. This online tool provides you with estimates of the LIC plan’s benefits and returns. You have just entered details like your age, policy term, and premium amount. After that, the LIC policy plan potential, maturity benefits, bonuses, and overall financial security will be displayed in front of you. It’s like having a financial advisor at your fingertips, guiding you to choose the best plan.

So, using this online calculator tool will help you differently. I will discuss this in detail in the later section. So keep reading this article and leran more details about what is LIC Plan Calculator. How does the LIC Plan Calculator work? and why it’s important for every individual. Let’s dive into this-

Key Features LIC Plan Calculator?

Our online LIC Plan Calculator includes several key features and benefits. This makes a user-friendly and efficient tool for insurance planning:

- Customizable Plan Options: This calculator allows you to customize any plan according to your needs and preferences. This includes; Term Insurance Plans, Endowment Plans, Money-Back Plans, Pension Plans and Unit-Linked Insurance Plans (ULIPs).

- Accurate Premium Calculations: The LIC Plan Calculator uses the LIC’s official premium calculation logic, functions and formula to provide you most accurate premium estimates. It takes into account some factors; such as the user’s age, gender, sum assured, policy term, and premium payment mode to determine the premium amount.

- Comparison of Different LIC Plans: Yes, if you planning to invest best LIC Policy. It’s important to compare it with other plans to make an informed decision on which is the best suit for you. Our LIC plan Calculator will allow users to compare multiple LIC plans side-by-side. This will help you to evaluate and choose the most suitable option.

- Projections of Maturity and Surrender Values: On the other hand, our LIC Plan Calculator provides you with projections of maturity and surrender values. This will be based on the selected plan and parameters chosen by you. This information helps users to understand the potential returns. After that, you can be assured to expect LIC policy and plan finances accordingly.

- Hassle-Free and Time-Efficient: Finally, I can say that using our LIC Plan Calculator is a hassle-free and time-efficient process. This will save you time and make you a quick decision. This calculator instantly generates the required information, saving users time and effort compared to manual calculations. You can access our calculator through the LIC plan Calculator website.

How to Use the LIC Plan Calculator?

The LIC Plan Calculator interface is very easy and simple to use. First, you need to select the specific plan that you are interested in. After that, input your basic information; such as age, sum assured, premium amount you wish to pay and the policy term. Finally, hit the calculate button, output result will display.

This calculator will provide you with a detailed summary of your potential returns, including maturity benefits and bonuses. This user-friendly calculator tool is designed to simplify complex calculations, making it accessible to everyone.

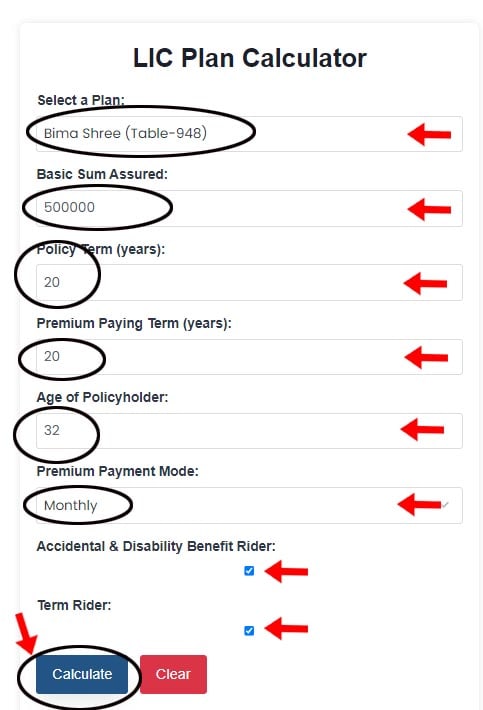

Here in the below, I have provided step-by-step guides-

Step 1: Open the LIC Plan Calculator by visiting; www.licplancalculator.com

Step 2: Next, the LIC Plan Calculator interface is displayed in front of you. Now put your required information;

- Select a Plan ( the LIC plan will be displayed in the box, select anyone)

- Enter Basic Sum Assured in the box.

- Put Policy Term (in years)

- Premium Paying Term (in years)

- Age of Policyholder

- Premium Payment Mode (Choose anyone)

- Accidental & Disability Benefit Rider

- Term Rider

Step 3: Now Click on “Calculate Button” Your selected LIC Plan details will be displayed right below to the calculator section. Thats it.

Input parameters explained

Calculators ask for various details. Age impacts premium amount. Sum assured determines coverage. Policy term affects maturity benefits. Premium paying terms influence affordability. Some calculators ask about lifestyle habits. Others inquire about existing policies. Be accurate with inputs for reliable results.

Interpreting the results

Results show estimated premiums. They display potential maturity benefits. Some calculators break down returns year-wise. Others show tax benefits. Compare these figures with your goals. Check if premiums fit your budget. See if the maturity amount meets future needs. Use results as a starting point for decision-making.

Factors to Consider When Using LIC Plan Calculators

- Age and life stage: Your age affects premiums. Younger people generally pay less. The life stage determines insurance needs. Single? You might need less coverage. Married with kids? Consider higher sum assured.

- Income and financial goals: Current income impacts affordability. Future income growth matters too. Short-term goals need different plans. Long-term objectives require another approach. Align calculator inputs with your financial roadmap.

- Risk appetite: Some prefer guaranteed returns. Others can handle market-linked plans. Risk tolerance influences plan selection. Conservative? Look at traditional plans. Aggressive? Explore ULIPs.

- Policy term and premium paying term: Longer terms often mean lower premiums. But they require a longer commitment. Shorter premium paying terms increase affordability. Match these with your financial situation.

- Riders and additional benefits: Riders enhance policy benefits. They come at an extra cost. Consider critical illness rider. Or accidental death benefit. Add these to calculators to see the overall impact.

Tips for Maximizing the Effectiveness of LIC Plan Calculators

- Regular reassessment of insurance needs: Life changes, so opting an insurance is important. Reassess periodically. Use calculators to check if current policies suffice. Adjust coverage as the family grows. Or as income increases.

- Comparing multiple plans: Don’t settle for the first option. Compare different plans. Use various calculators. See which offers the best value. Look beyond premiums. Consider overall benefits.

- Understanding tax implications: Many LIC plans offer tax benefits. Calculators often show tax savings. Understand Section 80C benefits. Check how the maturity amount is taxed. Factor this into your decision.

- Considering inflation and future expenses: Today’s sum assured might not suffice tomorrow. Inflation factor, estimate future expenses. Use calculators to see if the policy covers inflated costs. Adjust inputs accordingly.

Limitations of LIC Plan Calculators

Estimations vs. actual policy details

Calculators provide estimates. Actual policy might differ slightly. They don’t consider underwriting factors. Health conditions may affect the final premium. Use results as a guide.

Market fluctuations and bonus declarations

For participating policies, bonuses vary. Market conditions affect ULIP returns. Calculators use assumed growth rates. Actual performance may differ. Keep this in mind while planning.

Personal health and lifestyle factors

Calculators don’t consider detailed health info. Smoking or health issues may increase premiums. Final rates depend on medical tests. Use calculator results as ballpark figures.

Integrating LIC Plan Calculators with Overall Financial Planning

- Aligning insurance with investment goals: Insurance isn’t just protection. It’s part of financial planning. Use calculators to see how policies fit the overall strategy. Check if they complement your investments.

- Balancing protection and savings: Pure protection plans are essential. Savings-linked policies build corpus. Use different calculators. Strike balance between coverage and wealth creation.

- Coordinating with other financial instruments: Insurance works with other investments. Use calculators alongside investment tools. See how LIC plans complement mutual funds or fixed deposits. Create a holistic financial plan.

Conclusion

LIC plan calculators simplify complex decisions. It provides quick estimates. You can compare various policies easily. But remember, they’re tools, not decision-makers. Use them wisely. Consider your unique needs. Factor in limitations. Integrate results with an overall financial plan. Make informed choices. Your future self will thank you!

FAQs

What is the minimum sum assured I can calculate using the LIC Plan Calculator?

The minimum sum assured varies by plan. Generally, it’s around ₹1 lakh. Some calculators allow lower amounts. Check specific calculators for exact limits.

Can I use the LIC Plan Calculator for policies from other insurance companies?

No, LIC calculators work only for LIC policies. Other insurers have their tools. Use company-specific calculators for accurate results.

How accurate are the results from an LIC Plan Calculator?

Results are estimates. They’re fairly accurate for standard cases. Actual policy may differ slightly. Factors like health can affect the final premium.

Do I need to provide personal information to use the LIC Plan Calculator?

Basic details are required. Age, gender, and policy terms are common inputs. No sensitive information is needed. Calculators don’t store your data.

Can the LIC Plan Calculator help me decide between different types of policies?

Yes, calculators compare various plans. They show premiums and benefits. You can see which policy suits your needs best. Use multiple calculators for a comprehensive comparison.

Ready to explore LIC plans? Try the LIC plan calculator now! It’s free, easy, and informative. Still have questions? Contact an LIC agent. They can provide personalized advice. Remember, the right information leads to the right decisions. Start your journey towards financial security today!